In-house accountant vs offshore accountant

An accountant plays an important role in businesses. They are responsible for managing the finances of a company and ensure compliance with the law. It is their job to assess a company’s current financial position and guide them in their future business decisions accordingly. Without an accountant, a company is prone to suffer losses.

Yet, not every company can maintain and manage an accounting department comprising various roles in their company. Unless you are a big organization, it is not feasible. Most companies hire a bookkeeper and an accountant to keep their finances in order. The question now arises, whether or not your company should keep this function in-house. We are living in times when offshoring is looked at as an ideal solution for various services. Your company can partner with an offshore staffing service provider and hire an offshore accountant to handle your accounting needs. So, do you hire an in-house accountant or an offshore accountant? Let us take a look at it.

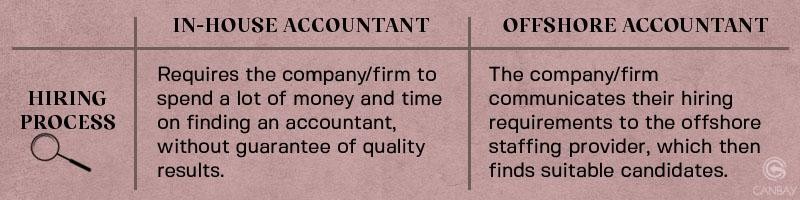

Hiring Process

Every company knows the complex nature of hiring. It is a laborious process that involves countless hours being spent on a job posting, resume reviewing, candidates screening and shortlisting, and interviewing. It is a lot of work with no guarantee of quality results. You may end up finding a perfect accountant, or you end up with a sub-par accountant with basic skills in the field. Hiring takes up a lot of the company’s resources. If your company hires an accountant in-house, they will have to spend a lot of time and money on it.

On the other hand, offshoring asks you to simply communicate your exact requirements to the staffing vendor who is then responsible for recruiting and hiring the potential candidate. They shortlist the top candidates from their databases and forward them to you for an interview. You have control over the final decision to hire the employee without actively participating in the process. You save money and time.

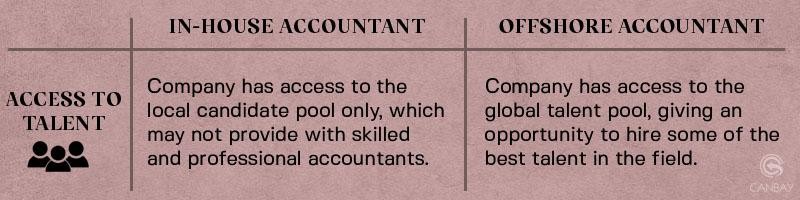

Access to professionals

We stated earlier how the role of an accountant is essential for any company. They are responsible for the company’s financial well-being, and you wouldn’t want an accountant who is less than excellent to be in control of such an important role. But sometimes, companies don’t have an option but to make do with the best they get. Hiring an in-house accountant means having access to the local candidate pool only. It severely limits your hiring potential. But you don’t have an option unless your company can offer a big enough incentive to convince a candidate to move across cities for the job. Your company may have to settle for the low quality of services.

Offshoring provides you access to global talent. You don’t have to worry about geographical boundaries because the accountant will be working for you remotely. Your company can research offshore destinations based on talent availability in the accounting field and choose the option that provides some of the top accountants. You get access to a global pool of talent comprising professionals who possess the required qualifications and skills to provide you high-quality services. You don’t have to settle. You can hire one of the top accountants for your company.

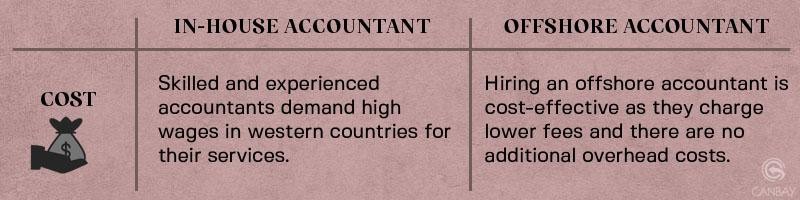

Cost

Accountants don’t come cheap. Getting access to their services can cost a company a lot. On average, an accountant in the US makes about $50,000-$60,000 annually. Add to it the employee benefits that all companies have to provide and the overhead charges, hiring an in-house accountant can be expensive. Your business will be benefiting from their services but not without spending a lot.

Hiring an offshore accountant is a lot more cost-effective. Because of the lower cost of living in offshore destinations, accountants charge fees which is a lot less compared to accountants in western countries. So, you’ll be accessing high-quality services but at a significantly lower price, effectively saving money for your company. Additionally, there will be zero overhead costs—no extra office space, no office supplies, no insurance, payroll, etc. You are paying only for the services of the accountant.

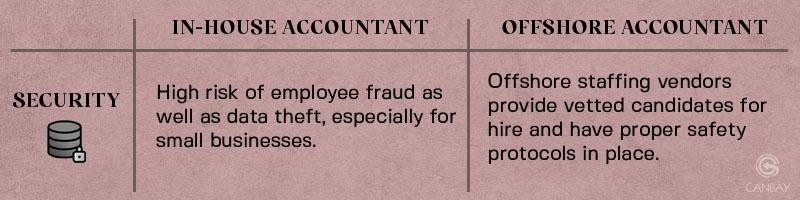

Security

We have all heard of cases of employee fraud. In-house accountants are not only privy to the sensitive financial information of a company, but they have access to the company’s other systems as well. It makes a company more prone to fraud, especially a small business that may not have great accounting controls and annual audits. Other than fraud, it is also a question of computer systems and network security that ensures safety from online breaches. A lot of companies are at risk of data theft because of inadequate safety measures.

When you hire an offshore accountant, you partner with an offshore staffing vendor (unless you are hiring a freelancer). It means your accountant is being monitored regularly by their staff when working for you. Furthermore, the vendor is responsible for the employees they provide to their clients. If they provide an employee who commits fraud, their reputation suffers, which impacts their business. So, the right staffing vendors select their candidates carefully after a thorough screening. It minimizes the risk of fraud. Similarly, they ensure that there is proper safety protocol in place to avoid online breaches and data theft. Their systems are secure, and they have NDA agreements with the employees. Your financial data is more likely to be safe with an offshore accountant than in-house.

Hiring an in-house accountant provides the advantage of getting to work with them in the same office, making communication easier. But it is not without its disadvantages. Hiring an offshore accountant can be more beneficial to companies, especially if they are a small business with limited resources.